At the end of 2016, the USDA published a final rule entitled “Enhancing Retailer Standards in the Supplemental Nutrition Assistance Program (SNAP).” See Federal Register This rule is aimed at “support[ing] healthy lifestyles for SNAP recipients”. Those retailers currently accepting SNAP benefits must adhere to the new requirements—the first of which goes into effect Monday, October 16, 2017—in order to continue accepting SNAP benefits.

What Do You Need to Do and When?

The new requirements of the SNAP program are coming due in short order, with the first going into effect next week: October 16, 2017. Failure to comply with these requirements could result in disqualification from the SNAP program, a civil penalty, and publication of the details of the retailer’s business and its violation. Some of the major changes are provided below.

New Restaurant Provision

The new definition of “restaurant” goes into effect on Monday, October 16, 2017. Why is this important? Because restaurants are not eligible for SNAP.[1]

“Restaurant” means any retailer having more than 50 percent of its total gross retail sales coming from:

1. foods cooked/heated on-site by the retailer before/after purchase;

2. hot and/or cold prepared foods not intended for home preparation or consumption—irrespective of whether the foods are consumed on-site or are sold for carry-out.

This change is significant because, under the new rule, foods heated on-site and consumed elsewhere are now specifically included in the calculation of food sales to be compared with gross retail sales for determining “restaurant” status. In other words, the likelihood that food sales exceed 50 percent of gross retail sales is now greater under the amended rule. This expansion of the restaurant exclusion could eliminate a multitude of retailers from the SNAP program.

New Stocking Requirements

By January 17, 2018, retailers accepting SNAP must stock “minimum amounts” of “staple foods” in their stores.

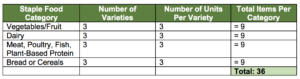

“Minimum amount” means 36 “staple foods,” from the following categories:

1. Vegetables or fruits

2. Dairy

3. Meat, poultry, fish, plant-based proteins

4. Bread or cereals

Perhaps we all remember health class and the food pyramid, so the food categories make some sense, but where does the number 36 come from? Well, USDA requires that retailers carry three varieties of food for each category and that retailer carry three units for each variety.[2] Further, at least six of the 36 items must be perishable (e.g. milk, chicken, eggs, raw vegetables), and the perishable items must come from at least two different “staple food” categories (e.g. dairy and vegetables).

Confused? Let’s use the Dairy Category for an example: In order to comply, a retailer must carry at least three different kinds of dairy product and three units of each different product.

Category – Dairy

Variety 1: yogurt, at least three units

Variety 2: milk, at least three units

Variety 3: butter, at least three units

What Does “Staple Food” Really Mean?

1. It Cannot be Hot

Staple foods cannot be sold “hot” because, as set forth above in the Restaurant Provisions, “[h]ot foods are not eligible for purchase with SNAP benefits and, therefore, do not qualify as staple foods[.]”

2. Multiple Ingredient Items Only Count for One Staple Category

Multiple-ingredient items and commercially processed foods (e.g. frozen pizza, frozen mac & cheese, etc.) that may include items from various categories will only count for “the staple food category of the main ingredient as determined by [the Food and Nutrition Service (FNS)].”

3. Multiple Ingredient Items Having Sugar as the Main Ingredient are Not Staple Foods

Where a multiple-ingredient item includes approved ingredient categories, but the main ingredient as determined by FNS is an “accessory food,” that food is not a staple food and is not eligible for purchase with SNAP benefits. For example, ice cream includes dairy, and perhaps plant-based proteins (nuts), but the main ingredient as determined by FNS is sugar (an “accessory food”) and as such is not eligible for purchase with SNAP.

What are the Costs of Non-Compliance?

According to USDA, if you are a store owner “who accepts SNAP benefits and your store breaks SNAP rules, then your name, the name of your store, and the nature of your violation will be made public starting on the date that this rule becomes effective [January 17, 2018].” In addition, the store may be disqualified from the SNAP program, or, in the alternative could be issued a civil penalty.

There are many other changes in the new rule. Contact a professional if you want to know more about the new requirements.

[1] USDA tightened this rule because “SNAP is intended to allow participants to purchase foods to prepare and consume at home.” (emphasis added).

[2] “Variety” means different products either based on main ingredient or product kind. Note that, different brands of the same product type do not constitute a separate variety item.

Disclaimer: This article is provided as general information only. This is not legal advice, and nothing about this article creates a legal relationship between the reader and Brownson • Norby, PLLC. Consult your own professional, or contact Tom Norby or Lindsey Streicher, if you have specific questions or concerns about the impact of this new rule on your operation. We expressly disclaim all liability relating to actions taken or not taken based on the contents of this article.